|

|

Carol H Tucker

Passionate about knowledge management and organizational development, expert in loan servicing, virtual world denizen and community facilitator, and a DISNEY fan

Contact Me

Subscribe to this blog |

beladona Memorial

Be warned:in this very rich environment where you can immerse yourself so completely, your emotions will become engaged -- and not everyone is cognizant of that. Among the many excellent features of SL, there is no auto-return on hearts, so be wary of where your's wanders...

|

Navigation Calendar

Days with posts will be linked

Most Recent Posts

|

|

|

the tax man cometh

Today is the 3rd day of the 16th week, the 18th day of the 4th month, the 108th day of 2017 [with only 250 shopping days until Christmas], and:

- Adult Autism Awareness Day

- Income Tax Pay Day

- Independence Day: Ireland left the British Commonwealth and became the Republic of Ireland in 1949; .Zimbabwe from the United Kingdom in 1980

- International Amateur Radio Day

- National Animal Crackers Day

- National Lineman Appreciation Day

- National Velociraptor Awareness Day

- Newspaper Columnists Day

- Pet Owners Independence Day

- World Heritage Day

ON THIS DAY: In 796 King Æthelred I of Northumbria was murdered in Corbridge by a group led by his ealdormen, Ealdred and Wada; the patrician Osbald was crowned, but abdicated within 27 days. In 1506 the cornerstone of the current St. Peter's Basilica was laid. In 1923 Yankee Stadium -- "The House that Ruth Built" -- opened. In 1946 the League of Nations went out of business.

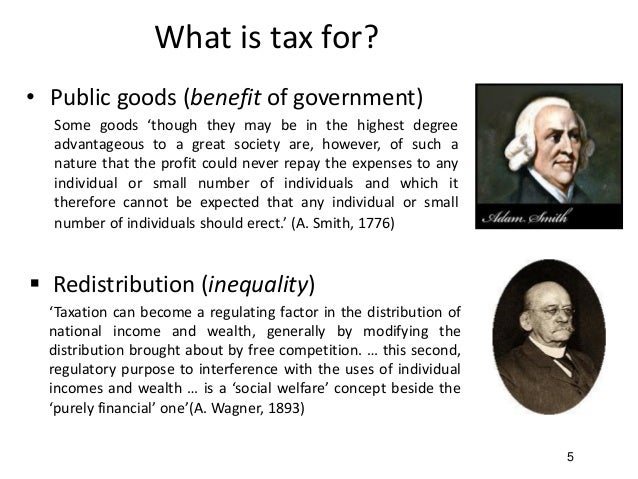

While the government imposed income taxes briefly during the Civil War and the 1890s, income tax as we know it didn't start on a permanent basis until 1913 when Congress enacted an income tax in October 1913 after ratification of the Sixteenth Amendment on February 3, 1913 as part of the Revenue Act of 1913 [AKA the Tariff Act, Underwood Tariff, Underwood Act, Underwood Tariff Act, or Underwood-Simmons Act] to replace the federal revenue that had been generated by customs duties (tariffs) and excise taxes.. The first income tax was a 1% tax on net personal incomes above $3,000, with a 6% surtax on incomes above $500,000. Originally Tax Day was March 1st [the first day was in 1914, one year after the ratification], but it was moved to March 15 in 1918 and then again to April 15 in 1955 – officially the reason for the pushback was to spread the workload of IRS employees, but some economists speculate that a later filing date means the government can wait even longer to pay refunds. During World War II, the financial burdens of the war forced the government to raise more revenue, more frequently, throughout the year. As the federal budget rose tenfold during the war, from $9 billion in 1940 to $98 billion in 1945, Congress passed a law called the Current Tax Payment Act introducing payroll withholding and quarterly tax payments to make sure citizens were paying up.

The result is if you work and receive payment, you will pay both income and FICA taxes; the latter is tax enabled by the Federal Insurance Contribution Act that contributes to Social Security and Medicare [/RANT: THEY ARE NOT ENTITLEMENTS THEY ARE PAID FOR WITH EACH PAY CHECK /end RANT]. You are not given a choice. There are a plethora of exemptions that our confusingly intricate tax laws provide that may get the government to refund all or some of those funds, if you are rich enough to afford the tax attorneys to find them. And just in case you somehow managed to game the system, you have to file each year to prove that you paid up and if you didn’t pay enough, write a check to the IRS.

I don’t think we would feel as bad about our donation to the federal, state and local governments if we knew everyone was paying their fair share, neh? For this reason, I have advocated a flat tax with no deductions for anyone [individual or business] making above a sustainable wage. Yes I know it sounds simplistic -- but at least we wouldn't be arguing about corproations using tax shelters, rich people who pay out such a low percentage of their income if anything at all, and politicians who lie about their returns, neh?

|

|

|

|

|